depreciation provision source of finance

Deduct the depreciation amount calculated in Step 3 from. In accounting and in most schools of economic thought fair value is a rational and unbiased estimate of the potential market price of a good service or asset.

Provision For Depreciation Basic Concepts Of Financial Accounting For Cpa Exam

Depreciation is a non-cash accounting expense that doesnt involve cash flow but it is a factor that can impact all areas of a companys financial performance.

. Long-term financing is a mode of financing that is offered for more than one year. Main Reception 01223 332299 University VAT registration. 01223 766631 Email See our list of available courses.

If you finance a buyers purchase of property and later acquire an interest in. Multiply the book value of the asset at the beginning of the year with the depreciation rate. Depreciation Rates as per Income Tax for FY 2020-21 AY 2021-22 Depreciation is allowed as deduction under section 32 of Income Tax Act 1961.

The Finance Division is here to support the academic research and administrative community at the University with sound financial advice and timely information with a range of support services including financial operations financial reporting financial support and professional services. Everything you need to know about the sources of getting long-term finance for a company firm or business. In computation of taxable income the depreciation rate as per income tax act will be allowed as deduction while depreciation as per book profit is added back.

Finance Division University of Cambridge Greenwich House Madingley Rise Cambridge CB3 0TX. Valuations can be done on assets for example investments in marketable securities such as companies shares and related rights business enterprises or intangible assets such as. It is required by an organization during the establishment expansion technological innovation and research and development.

In accounting and finance a profit margin is a measure of a companys earnings or profits relative to its revenue Sales Revenue Sales revenue is the income received by a company from its sales of goods or the provision of services. SAN MATEO Calif February 02 2022--Essex Property Trust Inc. Depreciation base is the book value of the asset on the opening day of the tax period increased by the cost of acquisition creation renewal etc during the period and reduced by the sales price of the asset.

Ascertain the depreciation rate. If the asset was purchased in the middle of the year then a pro-rata rate of depreciation will be applied. For assets for which the pooling method is used the rate is applied to the depreciation base for the determination of depreciation.

The sale of the elevator is a sale of a portion of a MACRS asset the building. Depreciation deducted on the old elevator portion of the building was 2500 before its sale. In addition long-term financing is.

GB 823 8476 09 EORI number. This publication contains a review of changes made in Income Tax Ordinance 2001 Sales Tax Act 1990 Federal Excise Act 2005 and The Customs Act 1969. Get the detailed quarterlyannual income statement for McDonalds Corporation MCD.

NYSEESS announced today its fourth quarter and full-year 2021 earnings results and. Types of Provision Companies may have different kinds of provisions such as building provision for depreciation Provision for future loss on the sale of assets provision for debtors which can be expected to. In finance valuation is the process of determining the present value PV of an assetIn a business context it is often the hypothetical price that a third party would pay for a given asset.

The derivation takes into account such objective factors as the costs associated with production or replacement market conditions and matters of supply and demandSubjective factors may also be considered such. The National Assembly approved the Finance Bill 2021 with certain amendments proposed therein and after the assent of the President of Pakistan Finance Act 2021 has been enacted on 30 June 2021. Your loss on the sale of the elevator is figured as follows.

Read more provision provision for bad and doubtful debts etc. Determine the book value of the asset at the beginning of the year. ABCAUS Excel Depreciation Calculator FY 2020-21 under Companies Act 2013 as per Schedule-II Version 0504 The maiden ABCAUS Excel Companies Act 2013 Depreciation Calculator was first launched in March 2015.

The ABCAUS Depreciation calculator for FY 2020-21 has also been formulated and styled the same way as its. What is a Profit Margin. Find out the revenue expenses and profit or loss over the last fiscal year.

:max_bytes(150000):strip_icc()/Walmart202010KIncomestatement-365d4a49671b4579a2e102762ada8029.jpg)

Operating Income Before Depreciation And Amortization Oibda Definition

What Is Provision For Depreciation Quora

Provision For Depreciation Basic Concepts Of Financial Accounting For Cpa Exam

Straight Line Depreciation Bookkeeping Business Accounting Basics Learn Accounting

Provision For Depreciation Basic Concepts Of Financial Accounting For Cpa Exam

Financial Statements 1 Class 11 Notes Accountancy Chapter 9 Financial Statement Financial Financial Position

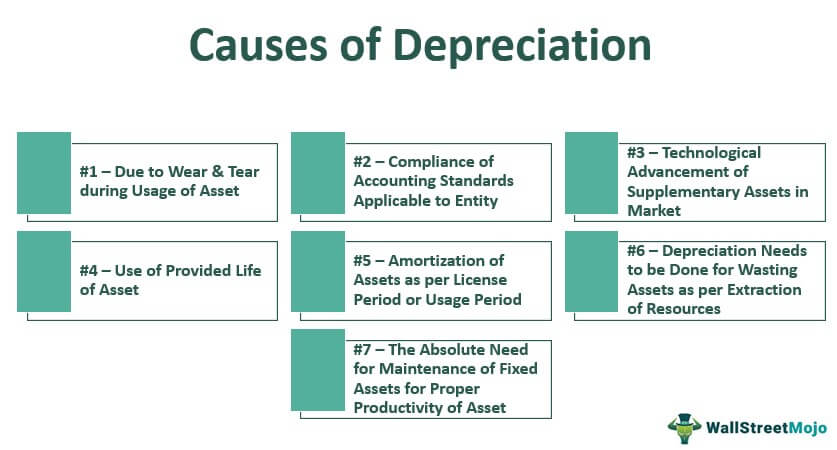

Causes Of Depreciation Top 7 Causes Of Accounting Depreciation

Provision For Depreciation Basic Concepts Of Financial Accounting For Cpa Exam

What Are The Sources Of Business Finance Business Finance Finance Business

0 Response to "depreciation provision source of finance"

Post a Comment